“Help! An Inquiry dropped my Credit Scores over 50 points!”

Sound familiar? I actually hear this quite a bit: Inquiries causing a huge drop to a person’s credit scores and now they’re wondering if they should even apply any credit anymore (even though they need a car, want a house, etc.).

Truth be told, major credit score drops cannot be attributed solely to inquiries. They just don’t hold that much weight in the FICO scoring model.

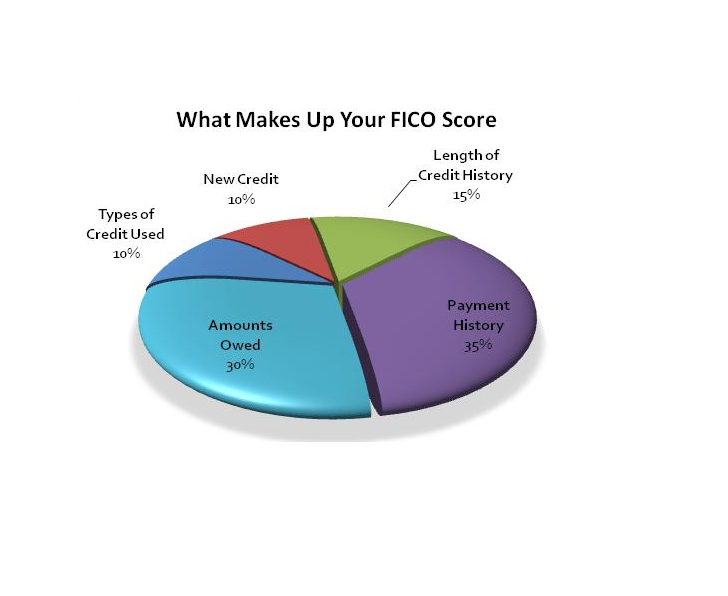

FICO has 5 major categories that our credit behaviors are scored on, and inquiries are housed in the New Credit category, and accounts for just 10% of our credit scores.

The New Credit category considers 5 key areas:

- How many accounts you have had opened in the past 6-12 months, how many of those accounts are new, by account type.

- How many recent credit inquiries you have.

- How long since you’ve opened up any new account, by account type.

- How long it's been since you’ve had any credit inquiries.

- The re-reporting on a credit report of positive credit history that had previously been derogatory.

As you can see, the New Credit category looks at the appearance of a new account AND the actual inquiry itself. This means that even if you obtain credit from a lender that does not do a ‘hard inquiry’, the mere appearance of a new account on your credit reports will fall into this category and can lead to a score drop.

Now, just to clarify, a hard inquiry is what can reduce your credit scores. This type of inquiry happens when you apply for credit, a loan, etc. If you were to check your own credit or complete a no credit check pre-qualification form; this is called a soft inquiry and has no impact on your scores at all.

Wait, Why Am I Being Penalized for Applying for Credit? I need it to rebuild my credit, buy a home, finance a car, obtain utilities, a cell phone (you get the picture ?)

Applying for credit to obtain the things/items you need is totally fine and I encourage you to do so. Thinking long-term, New Credit can help or hurt your credit, depending on what else is reporting on your credit reports. With good payment history (35% of your FICO scores), your credit scores will recover well beyond the potential decrease from a hard inquiry.

Just keep in mind that FICO views inquiries as an indication of risk, so if you were to apply for 15 credit cards in one week, the risk of a lender doing business with you increases. Fortunately, its temporary, and the effects to your FICO scores are short-term as well.

There are times, however, when shopping around for the best deal makes sense. FICO thinks so as well, which is why they have implemented a shop-around-rule. This is only applicable to car loans, home loans and private student loans. Credit cards and personal loans do not apply.

The shop-around-rule allows you to shop around for the best rates without any impact to your scores for 30 days. Once the 30 days have passed, FICO will treat all of the inquiries as ONE inquiry, as long as they occurred within a 45-day window. This helps limit the damages to your FICO score, being that every single inquiry isn’t scored independently.

Now… Back to the original concern: Can A Person’s Credit Score Drop over 50 points from Inquiries?

It’s highly unlikely. On average, the decrease in credit scores is about 5 points. That can go up or down depending on how long your credit history is, your credit score range, and how many inquiries you’ve had in the past 6-12 months.

This confuses so many of my students, because credit monitoring services can falsely accuse inquiries as the primary reason for their significant credit score drop, when it usually isn’t. Inquiries just don’t hold that much weight in the FICO scoring model.

Here’s what I want you to look for instead:

- Go to the archived reports section of your credit monitoring report and print it out.

- Print the current month’s credit report, showing the credit score drop

- Go to the Score Factors section of each credit report and compare.

- The score factors will show you the reason codes on your credit report. Each code represents a reason why your score could be higher, and they are listed from most impact to least impact on your scores (there will be up to 5). Here, you’ll be able to see:The top reason code may show some variances, considering the credit score drop.

In most cases, it’s a new derogatory account reporting, or a credit card has been closed thus affecting your overall debt-to-credit utilization, or your credit card usage has significantly increase, thus negatively impacting your debt-to-credit utilization.

Hope this helps!

If you need help Soaring Your Credit Scores, I’d love to help ?

Visit www.SoarMyScores.com!

3 Responses

Yes it can make it go down 50 points. Mine did today even though everything else on my report is the same and balances decreased.

ONE inquiry made your scores go down 50 points? Maybe you’re an anomaly. However, with the entire category that inquiries make up, less than 10% of your scores are impacted by an inquiry. With 300 being the lowest score anyone can have on a standard credit scoring range, and 850 being the highest, that would mean that out of a perfect 850, 10% of that 550 available points (850-300 = 550 available points to all consumers); your scores were impacted by 50, which is about 9%. It’s unlikely, however, I am going by the FICO scoring model. If you’re using another scoring model; they may be calculating your risk and inquiries differently. Thanks for commenting :).

I think this is all BS, but I applied for 1 card and it dropped me 18 points. I never went under 800 but I was upset. I had not had an inquiry for years, I saw the impact.